- Posts: 10451

- Thank you received: 70

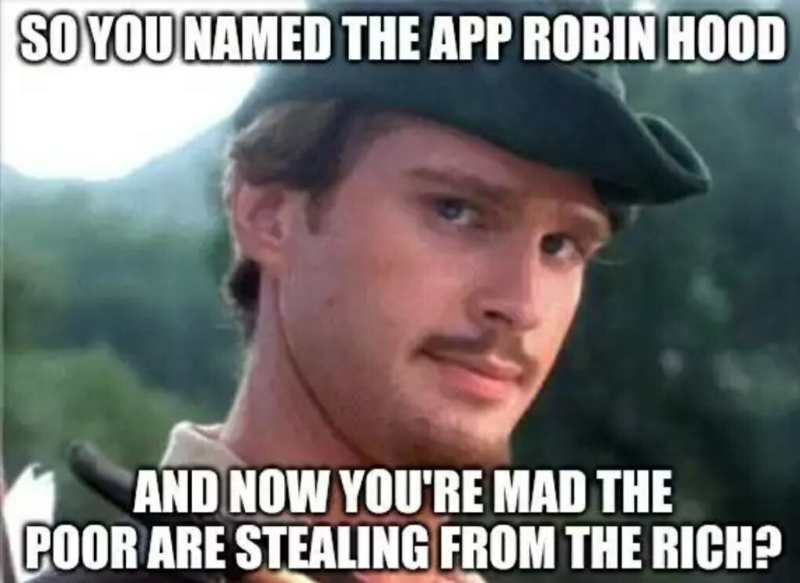

GameStop Rally Sinks Hedge Funds

- Blazer Bob

-

- Mountain Legend

-

ramage wrote: To explain my comment: SOES, = Single Order Execution System. The following citation is a concise history of this form of day trading and well worth 10-15 minutes of reading time.

www.warriortrading.com/soes-bandits/

Please Log in or Create an account to join the conversation.

- ramage

-

- Mountain Legend

-

- Posts: 4388

- Thank you received: 94

140% of GME was shorted.

By definition: Naked shorting is the illegal practice of short selling shares that have not been affirmatively determined to exist.

By definition the Hedge funds were doing naked shorts.

Please Log in or Create an account to join the conversation.

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 30574

- Thank you received: 179

Naked Shorts aren't illegal, they are risky however, limited reward, unlimited risk.ramage wrote: The same people telling you the hedge funds aren’t manipulating the system are telling you there was no vote fraud in the last presidential election.

140% of GME was shorted.

By definition: Naked shorting is the illegal practice of short selling shares that have not been affirmatively determined to exist.

By definition the Hedge funds were doing naked shorts.

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- ramage

-

- Mountain Legend

-

- Posts: 4388

- Thank you received: 94

To understand naked short selling, it is important to first have an understanding of short selling. Short selling a stock is a legal trading technique where a trader borrows securities from a shareholder with the understanding that they will be returned upon demand. The trader then sells and delivers the securities to a buyer. A trader does this in hopes that the price of the securities will drop so that he or she can buy them back and return them to the lender, thus making a profit.

Naked short selling is closely related, but it has an illegal twist. Short sales are considered naked when securities are sold without first being borrowed from a shareholder. Because no real securities have been sold, they are often not delivered in time."

Please see regulation SHO

The Securities and Exchange Corporation (SEC) is an independent federal government agency responsible for protecting investors, maintaining fair and orderly functioning of securities markets and facilitating capital formation. It enforces legislation that was first passed in 1938 to address short selling. There was no further legislation until 2005 when Regulation SHO was implemented specifically to address naked shorting issues that were a result of the move to the electronic clearing and settlement system.

smithonstocks.com/part-6-illegal-naked-s...-but-is-ineffective/

www.sec.gov/fast-answers/answersregshohtm.html

Please Log in or Create an account to join the conversation.

- homeagain

-

- Mountain Legend

-

- Posts: 12728

- Thank you received: 173

Found this to be clear and concise about the "game"....."gamers" are hitting the brick wall....the scheme

is screwed.

Please Log in or Create an account to join the conversation.

- homeagain

-

- Mountain Legend

-

- Posts: 12728

- Thank you received: 173

The grand AWAKENING...as described Kevin Simpson, portfolio Mgr.

Please Log in or Create an account to join the conversation.

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 30574

- Thank you received: 179

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- Blazer Bob

-

- Mountain Legend

-

- Posts: 10451

- Thank you received: 70

FredHayek wrote: Will Silver be the next market to be disrupted? Commodity traders have been short selling silver futures. What happens if the price spikes and then they have to deliver silver in March at twice the price? The silver market has been tampered with before, the Hunt Brothers tried to corner the market in the 1980's. They failed and took a big hit to their wealth.

Didn't they go to jail?

Please Log in or Create an account to join the conversation.

- Pony Soldier

-

- User is blocked

-

- Posts: 4749

- Thank you received: 43

Please Log in or Create an account to join the conversation.

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 30574

- Thank you received: 179

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.