- Posts: 14880

- Thank you received: 27

Tax Cuts For Wealthy Cost Treasury $11.6 Million Every Hour

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

Tax Cuts For Wealthy Americans Cost Treasury $11.6 Million Every Hour: Report

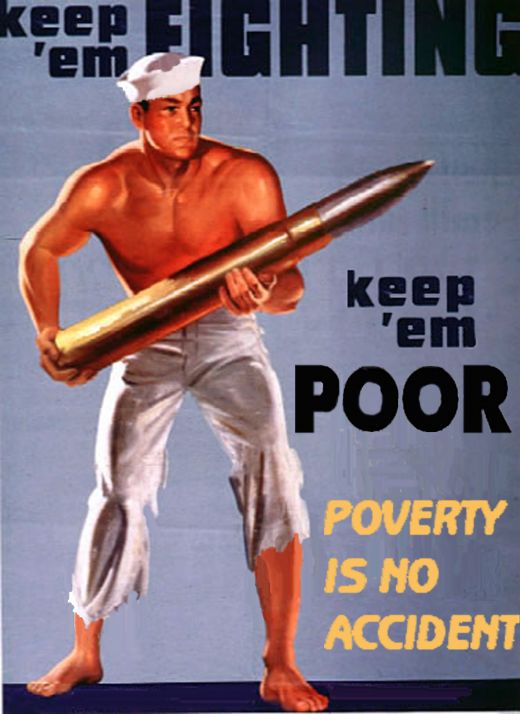

Tax cuts for America’s top earners are costing everyone, every hour of every day, a new report from the National Priorities Project finds.

Tax cuts for the wealthiest five percent of Americans cost the U.S. Treasury $11.6 million every hour, according to the National Priority Foundation. America’s top earners will get an average tax cut of $66,384 in 2011, while the bottom 20 percent will get an average cut of $107.

The report comes as party leaders wrangle over the best way to curb the nation’s budget deficit, protesters around the world demonstrate against income inequality and corporate greed and Republican presidential candidates offer their economic plans to voters. Former pizza company CEO and Republican presidential candidate, Herman Cain, has been getting lots of attention in recent weeks for “999 Plan” which would cap the corporate, income and sales tax rates at 9 percent.

Still, there are some Republicans who support increasing taxes on the wealthy. Former Federal Reserve Chairman Alan Greenspan -- a registered Republican -- told CNBC earlier this month that he supports allowing the George W. Bush-Era tax cuts for the wealthy to expire.

That could because the tax cuts are weighing on the national debt. The non-partisan Center for Budget and Priorities found that the Bush tax cuts costs about the same as the shortfall from Social Security in the ten years after they were signed into law. If the U.S. reverted to Clinton-era marginal tax rates, the U.S. Treasury would net an additional $72 billion annually, according to Citizens for Tax Justice.

In addition, increasing taxes on the wealthy could also help to narrow the widening wealth gap. The net worth of the bottom 60 percent of U.S. households -- about 100 million households -- is lower than that of Forbes 400 richest Americans. Tax cuts for the wealthy provided Americans making more than $1 million with a $128,832 benefit, while Americans earning from $40,000 to $50,000 got an $860 benefit on average.

http://www.huffingtonpost.com/2011/10/1 ... 11601.html

But hey, it's supposed to "trickle-down", right?

Please Log in or Create an account to join the conversation.

- Rick

-

- Mountain Legend

-

- Posts: 15615

- Thank you received: 163

The left is angry because they are now being judged by the content of their character and not by the color of their skin.

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30853

- Thank you received: 179

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- Rick

-

- Mountain Legend

-

- Posts: 15615

- Thank you received: 163

But it does make the liberals feel better, even if it's just small change in the big picture.SS109 wrote: And if you removed all these "tax cuts", we would still be adding trillions in debt. It isn't a taxing problem, it is a spending problem.

The left is angry because they are now being judged by the content of their character and not by the color of their skin.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

Please Log in or Create an account to join the conversation.

- Wayne Harrison

-

- Mountain Legend

-

- Posts: 6722

- Thank you received: 72

Please Log in or Create an account to join the conversation.

- Residenttroll returns

-

- Mountain Legend

-

- Posts: 4630

- Thank you received: 0

Estimates by the Urban-Brookings Tax Policy Center project that for tax year 2011, 46.4 percent of households won’t have any income tax liability. However, of this number, 28.3 percent will pay payroll taxes, the center projects. Of the remaining 18.1 percent with neither income nor payroll tax liability, 10.3 percent are elderly and 6.9 percent are not elderly but have incomes lower than $20,000. In other words, all but a tiny sliver of Americans without either income tax or payroll tax liability are either elderly or poor.

Some families who pay no federal income tax may be liable for state income taxes (and local property taxes, sales taxes and the like). But Cornyn began his remarks by talking about "federal tax reform," so we won't fault him for not mentioning that.

There are enough different ways to look at the tax burden to allow all sides to pick and choose tax statistics that favor their positions.

Conservatives have a point that richer Americans pay the lion’s share of federal taxes. In 2007, according to the Urban-Brookings Center, the richest 20 percent paid 68.9 percent of federal taxes, and the top 1 percent paid 28.1 percent. (One would expect the rich to pay more, since they earn more, but these percentages are even higher than their share of the nation's total income. According to one frequently cited academic study, the top 20 percent earned 61.4 percent of income in 2006 and the top 1 percent earned 21.3 percent of income that same year.)

In addition, the richest 10 percent, 5 percent and 1 percent of taxpayers each paid significantly higher effective tax rates than Americans lower on the income spectrum.

http://www.politifact.com/truth-o-meter ... eholds-pa/

http://rickkomer.files.wordpress.com/2011/08/obama-cartoon.jpg?w=500&h=378

Please Log in or Create an account to join the conversation.

- Arlen

-

- Mountain Legend

-

- Posts: 1548

- Thank you received: 11

Please Log in or Create an account to join the conversation.

- Arlen

-

- Mountain Legend

-

- Posts: 1548

- Thank you received: 11

Please Log in or Create an account to join the conversation.

- Arlen

-

- Mountain Legend

-

- Posts: 1548

- Thank you received: 11

Please Log in or Create an account to join the conversation.