- Posts: 14880

- Thank you received: 27

Wall Street Whines About Obama, Despite Record Profits

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

Wall Street Whines About Obama, Despite Record Profits

Bloomberg News had this report this morning, but I feel like I've been seeing the similar reports for quite a while.

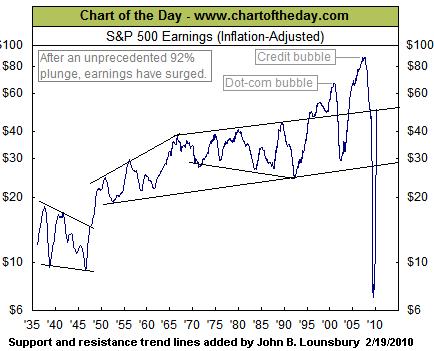

Investors around the world say President Barack Obama is bad for the bottom line, even though U.S. corporations are on track for the biggest earnings growth in 22 years and the stock market is headed for its best back-to-back annual gains since 2004.

That's certainly one of the classic sentences of the year. The Obama White House is bad for profits, according to those making lots of money in the Obama era.

Indeed, we learned just two weeks ago that corporate profits since Obama's inauguration that have risen faster "than during any other 18-month period since the 1920s." All told, profits have surged 62% from the start of 2009 to mid-2010, according to the Commerce Department. "That is faster than any other year and a half in the Fabulous '50s, the Go-Go '60s or the booms under Presidents Ronald Reagan and Bill Clinton."

Obama's bad for the bottom line? Are these people serious?

http://www.alternet.org/newsandviews/ar ... paragraph6

Would they like some cheese with that whine?

Please Log in or Create an account to join the conversation.

- LOL

-

- Mountain Legend

-

- Posts: 6393

- Thank you received: 18

If you want to be, press one. If you want not to be, press 2

Republicans are red, democrats are blue, neither of them, gives a flip about you.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

...62% from the start of 2009 to mid-2010, according to the Commerce Department.

Please Log in or Create an account to join the conversation.

- LOL

-

- Mountain Legend

-

- Posts: 6393

- Thank you received: 18

http://seekingalpha.com/article/189606- ... ove-higher

If you want to be, press one. If you want not to be, press 2

Republicans are red, democrats are blue, neither of them, gives a flip about you.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

Joe wrote: What was the point again?

"profits have surged 62% from the start of 2009 to mid-2010".... That was the point. Hmmmmm.... Now, who was president until January, 2009?

Please Log in or Create an account to join the conversation.

- Residenttroll returns

-

- Mountain Legend

-

- Posts: 4630

- Thank you received: 0

62% increase of 100 is just 62

31% increase of 1000 is 310

Which increase do you want?

Another reason for Looney Jerk to celebrate. Here's some examples of why companies are profitable and cash rich in 2010:

Many companies are focusing on cost-cutting to keep profits growing, but the benefits are mostly going to shareholders instead of the broader economy, as management conserves cash rather than bolstering hiring and production. Harley, for example, has announced plans to cut 1,400 to 1,600 more jobs by the end of next year. That is on top of 2,000 job cuts last year — more than a fifth of its work force.

At Ford, revenue in its North American operations is down by $20 billion since 2005, but instead of a loss like it had that year, the unit is expected to earn more than $5 billion in 2010. In large part, that is because Ford has shrunk its North American work force by nearly 50 percent over the last five years.

Joe, she's still trying to figure out why you need a 33% increase to cover the 25% loss.

http://www.economist.com/blogs/freeexch ... te_profits

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30159

- Thank you received: 178

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- Whatevergreen

-

- Mountain Advisor

-

- Posts: 281

- Thank you received: 0

How's that trickle-down thingy working for ya???

Please Log in or Create an account to join the conversation.

- outdoor338

-

- Mountain Legend

-

- Posts: 3660

- Thank you received: 0

Please Log in or Create an account to join the conversation.

- LOL

-

- Mountain Legend

-

- Posts: 6393

- Thank you received: 18

RT here is an easier one for LJ, a 50% drop in earnings requires a 100% increase to reach break even. Year to year and quarter to quarter percentages are great numbers for news articles. "Record profits" is another one I like. In a healthy economy, there should always be record profits year-year, look a long term charts and they are always trending higher for successful companies.

Hey LJ, how is the US post office doing? Losing billions during this time of recovering private sector earnings? Hmmm, for 50 outrage points, guess who runs the post office?

http://news.yahoo.com/s/ap/20101112/ap_ ... l_finances

If you want to be, press one. If you want not to be, press 2

Republicans are red, democrats are blue, neither of them, gives a flip about you.

Please Log in or Create an account to join the conversation.