- Posts: 43

- Thank you received: 1

Elk Creek Fire Mill Levy-Learn More. Info/Upcoming Meetings

- ASaferConifer

-

Topic Author

Topic Author

- Happy Camper

-

We have a couple of big meetings coming up that we'd like to invite you to attend and learn more about the Elk Creek Fire Protection District Mill Levy on the upcoming ballot.

Chief McLaughlin will be presenting tomorrow night at the Conifer Chamber's Public Affairs Committee Meeting. It's being held at Beaver Ranch at 6:30pm. You are welcome to come with questions!

On Wednesday night there is a Conifer Town Hall Meeting at West Jefferson Middle School. Chief McLaughlin is one of the presenters there as well, plus the Friends of Elk Creek Fire will have a table where you can come and get a flyer and ask questions after the meeting.

We hope to see you at either of these meetings. If you can't make it, we are organizing a community-wide meeting on October 2nd, held at Conifer High School. We'll share more details about that meeting as it gets closer.

Here is the video of Tom Carby, insurance agent with Farmers Insurance, and Michael Davis, ECFPD volunteer firefighter, presenting before the 285 Corridor Tea Party Meeting August 26th.

[youtube:3ee8ysfq][/youtube:3ee8ysfq]

PO Box 353, Conifer, CO 80433

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

A Safer Conifer Facebook Page

Please Log in or Create an account to join the conversation.

- ASaferConifer

-

Topic Author

Topic Author

- Happy Camper

-

- Posts: 43

- Thank you received: 1

From YourHub/Denver Post

http://www.denverpost.com/southjeffco/c ... -purchases

Mill levy hike meant to cover tanker, engine purchases for Elk Creek Fire Department

By Karen Groves

YourHub Reporter

09/12/2013

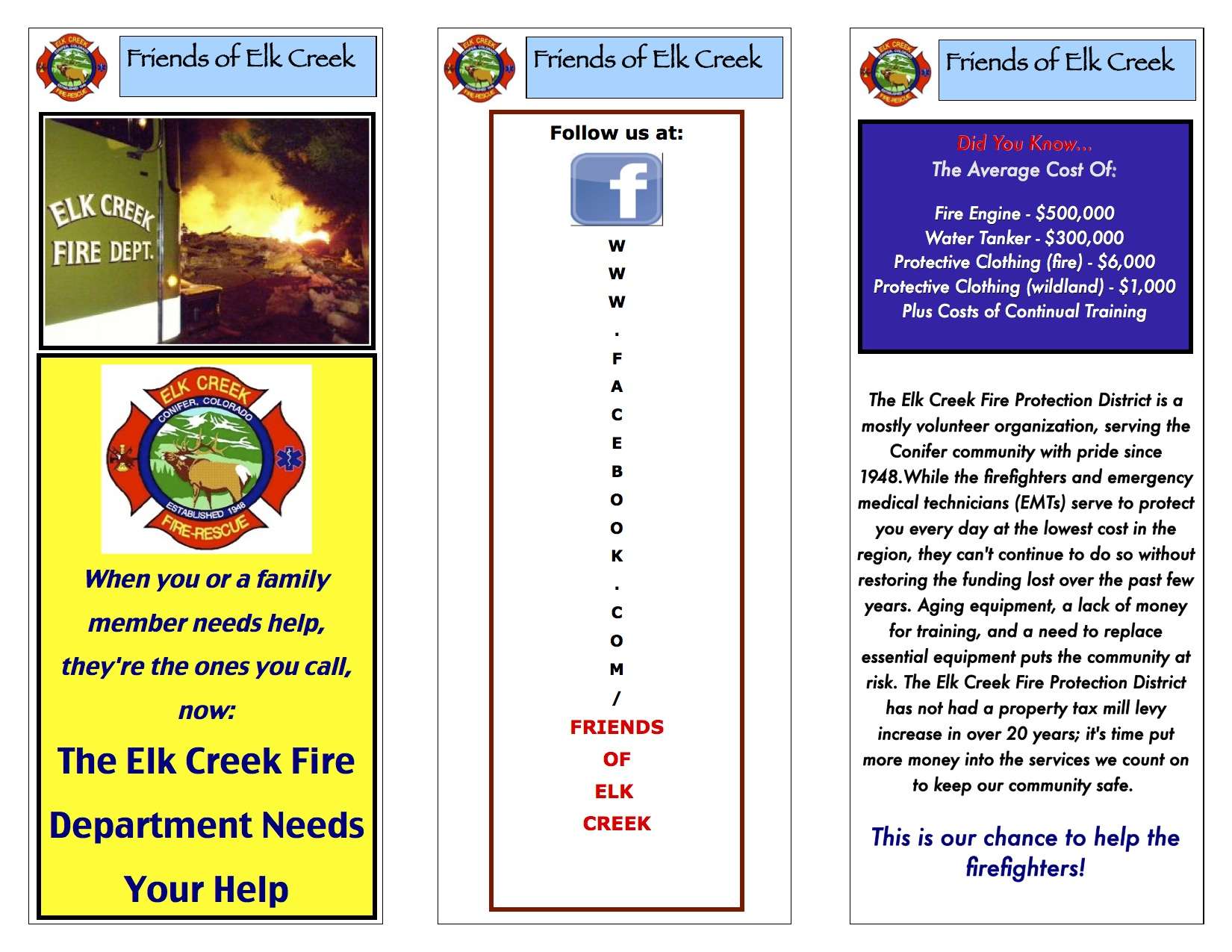

The Friends of Elk Creek is ramping up its campaign to help educate residents about a question on the November ballot that will pump funds into the Elk Creek Fire Department.

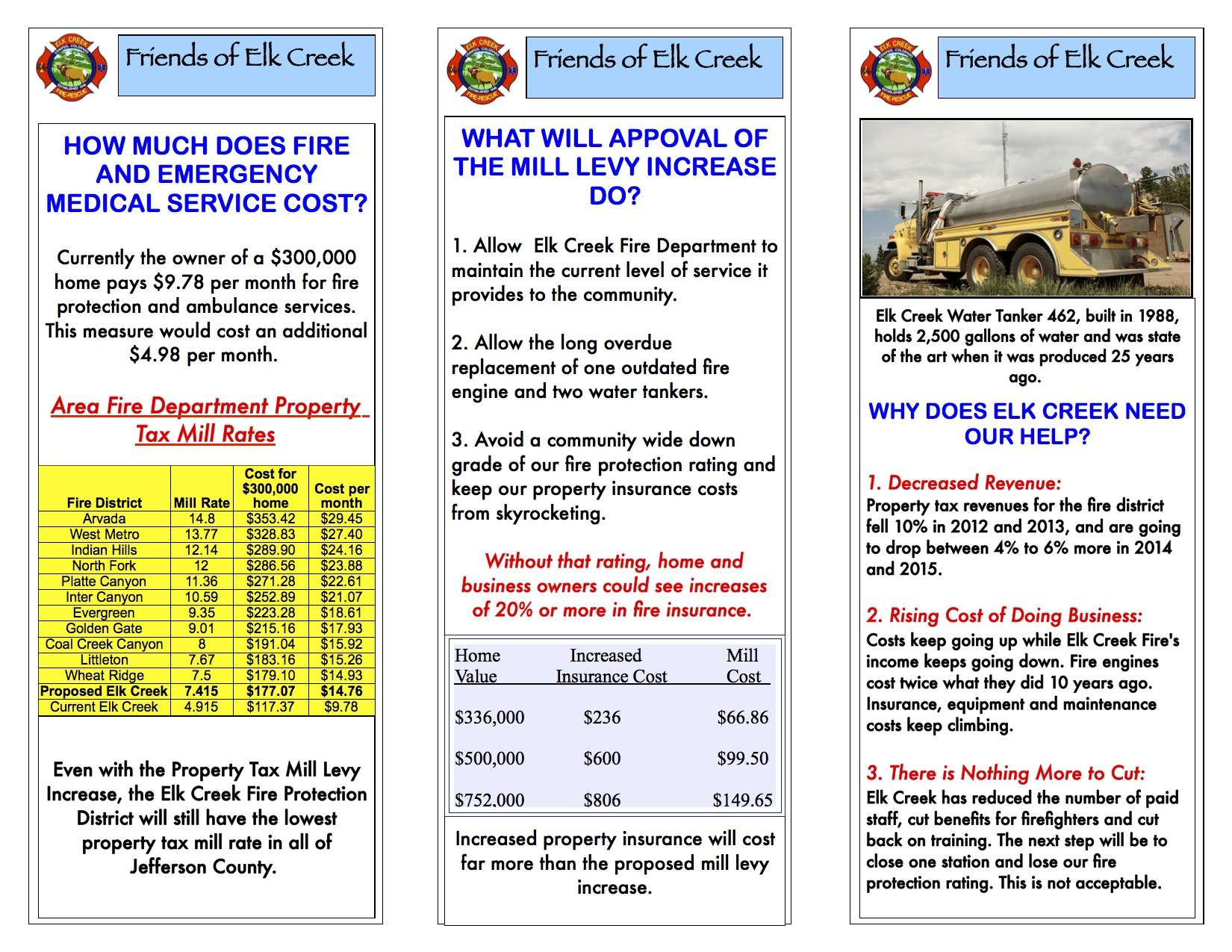

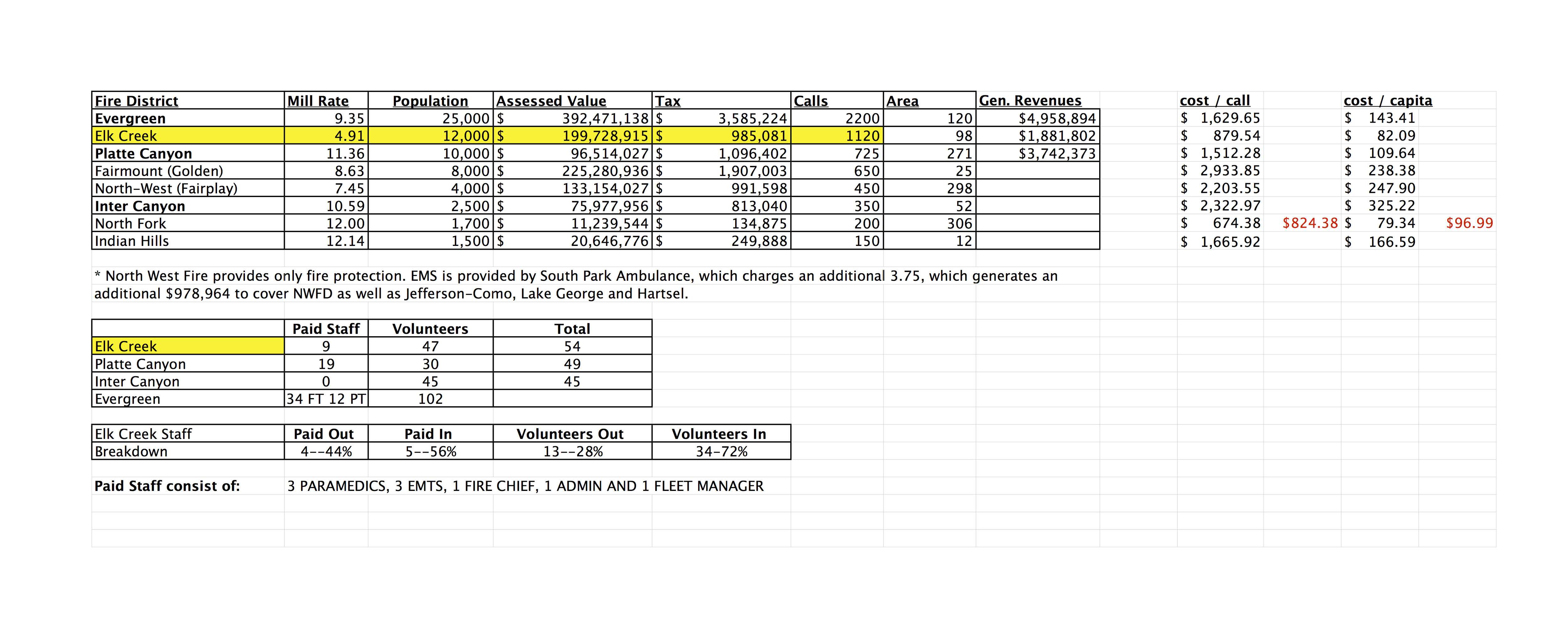

The question, which will be on the Jefferson County coordinated ballot, will ask voters to increase taxes by $482,138 in 2014 and by whatever tax revenues are generated by an ad valorem property tax rate of 2.5 mills to purchase two fire tankers and one fire engine. The 2.5-mill rate will expire in 10 years. It will raise the total mill rate to 7.415, which is less than the 9.35-mill rate in Evergreen.

"Compared to our neighboring fire departments, we are one of the lowest-funded departments," she said.

Michael Davis, an Elk Creek firefighter and homeowner, said he has been told by insurance professionals that if Elk Creek Fire Protection District cannot replace its old water tankers and the district loses its tanker credit, property owners' insurance rates will increase by between 20 percent and 50 percent depending on the location of the property.

For more information, go to http://www.elkcreekfire.org or on.fb.me/ 14r5OrK.

From The Flume:

http://www.theflume.com/news/article_a7 ... f6878.html

Friends of Elk Creek formed to back ballot issue

Community leaders briefed at Beaver Ranch meeting

Douglas Stephens, Correspondent | Sept 06, 2013

The Friends of Elk Creek Fire hosted an open house on Aug. 27 to acquaint members of the community with the proposed property tax increase on the November 2013 ballot.

Friends of Elk Creek, a committee registered with the Colorado Secretary of State, is tackling some of the educational aspects of the ballot proposal, which would increase the fire district’s property tax mill rate to 7.415 from 4.915.

A home with an actual value of $300,000 would have an assessed value of $23,880 (7.96 percent of the actual value) and by multiplying $23,880 times the 4.915 mill rate (.004915), that translates to an annual property tax on that $300,000 home of $117.37 tied to the fire district.

A mill rate of 7.415 would increase the annual tax on such a home to $177.07, an increase of $59.70 a year. The $177.07 works out to $14.76 a month.

Neil Whitehead III with the Friends of Elk Creek, a registered issue committee, outlines the breadth of the coverage area in the Elk Creek Fire Protection District at a Tuesday, Aug. 27, meeting of community leaders at Beaver Ranch. (Photo by Douglas Stephens/The Flume)

From the High Timber Times:

http://www.hightimbertimes.com/content/ ... x-increase

Elk Creek Fire will seek 2.5-mill tax increase

Measure on November ballot would cost owner of $200,000 home an additional $40 annually

By Daniel Laverty

Sunday, August 11, 2013

The Elk Creek Fire Protection District will ask voters for a 2.5-mill increase in the district’s property-tax rate in the Nov. 7 election.

If approved, the tax increase, which would expire after 10 years, would help fund the district’s plan to lease/purchase new vehicles and restore a budget that has seen nearly $500,000 in cuts since 2011.

“We cannot maintain our level of service with our current mill levy rate,” said Alec Schwartz, Elk Creek board member.

Elk Creek has asked voters numerous times for a tax increase in previous years, most recently in 2010, without success. The district posted an online survey in June, and 86 percent of the respondents favored a tax increase. Less than 150 people participated.

“This is the first time I’ve not heard a negative reaction (from the community) when it comes the subject of a mill increase,” said Stan Foxx, board member. “I think everyone understands our situation here.”

PO Box 353, Conifer, CO 80433

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

A Safer Conifer Facebook Page

Please Log in or Create an account to join the conversation.

- ASaferConifer

-

Topic Author

Topic Author

- Happy Camper

-

- Posts: 43

- Thank you received: 1

PO Box 353, Conifer, CO 80433

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

A Safer Conifer Facebook Page

Please Log in or Create an account to join the conversation.

- Venturer

-

- Mountain Legend

-

- Posts: 877

- Thank you received: 0

Please Log in or Create an account to join the conversation.

- ASaferConifer

-

Topic Author

Topic Author

- Happy Camper

-

- Posts: 43

- Thank you received: 1

Uploaded with [url=http://imageshack.us:2q4a61ia]ImageShack.us[/url]

The Chief made an excellent presentation at the Conifer Town Hall Meeting last week, here's just that segment of the evening:

[youtube:2q4a61ia][/youtube:2q4a61ia]

And Jennifer Eleniewski speaking about the impact on insurance rates:

[youtube:2q4a61ia][/youtube:2q4a61ia]

PO Box 353, Conifer, CO 80433

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

A Safer Conifer Facebook Page

Please Log in or Create an account to join the conversation.

- ASaferConifer

-

Topic Author

Topic Author

- Happy Camper

-

- Posts: 43

- Thank you received: 1

Elk Creek tax increase is debated at two events

By Daniel Laverty

Tuesday, September 24, 2013

The Elk Creek Fire District’s proposed tax increase continues to be a hot topic for Conifer area residents.

“I think the most important thing is getting information out so people can make an educated decision,” said Jennifer Eleniewski, chair of the Friends of Elk Creek.

Discussions occurred at two events last week: The Conifer Area Council’s public affairs committee hosted a forum Sept. 17 at which Fire Chief Bill McLaughlin and former board member Mike Bartlett spoke. McLaughlin also appeared at a town hall meeting the following night.

This November, the fire department is asking for a 2.5-mill increase in the property-tax levy that would sunset after 10 years.

Next up, the Friends of Elk Creek are hosting an informative meeting at 7 p.m. Oct. 2 at Conifer High School.

Contact Daniel Laverty at

PO Box 353, Conifer, CO 80433

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

A Safer Conifer Facebook Page

Please Log in or Create an account to join the conversation.

- Reverend Revelant

-

- Mountain Legend

-

- Posts: 7163

- Thank you received: 21

1) In your brochure you indicate a possible increase in property insurance up to 20%. Where did this figure come from?

Full disclosure: I ask this question in the capacity of a correspondent of the Park County Republican/Fairplay Flume newspaper and the answer may be used in an upcoming article.

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.

- Reverend Revelant

-

- Mountain Legend

-

- Posts: 7163

- Thank you received: 21

Walter L Newton wrote: A question.

1) In your brochure you indicate a possible increase in property insurance up to 20%. Where did this figure come from?

Full disclosure: I ask this question in the capacity of a correspondent of the Park County Republican/Fairplay Flume newspaper and the answer may be used in an upcoming article.

My question has been answered by a different source.

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.

- deltamrey

-

- Mountain Legend

-

- Posts: 1130

- Thank you received: 7

Please Log in or Create an account to join the conversation.

- Reverend Revelant

-

- Mountain Legend

-

- Posts: 7163

- Thank you received: 21

deltamrey wrote: WN.....that source (credible, certifiable please) would be ??.....TRUST but verify. The mountain communities are in a deep DEPRESSION.....the floods added insult to massive injury. Lets us not make this area A MINI-detroit (SOON TO BE CHICAGO, CLEVELAND, AKRON, ST. LOUIS......LIST IS LONG). The transplanted RUST BELT voters cxan learn......or not.

The answer to my question will be in my Flume article to appear in the Oct. 11th paper.

It will be a comprehensive look at the Tabor question with input from all sides, and possibly if I have the time, there will be additional input from a volunteer fire fighter.

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.