- Forum

- Mountain Classifieds

- Free Business & Member Classifieds

- Changes in CO Dept of Revenue's Emergency Sales Tax Rules. Hearing on Nov 30

Changes in CO Dept of Revenue's Emergency Sales Tax Rules. Hearing on Nov 30

- EvergreenChamber

-

Topic Author

Topic Author

- Mountain Advisor

-

I wanted to send you a couple updates on the Colo Dept of Revenue's emergency sales tax rules regarding the sourcing and remittance of local sales taxes. Below is a link to a Denver Post editorial from Friday calling for changes to the new rules and more simplification generally. Also, below see more messaging talking points and details for the upcoming CDOR hearing on this rule from the Simplify Colorado Sales Tax coalition.

www.denverpost.com/2018/11/22/this-black...-reform-in-colorado/

There is a hearing this Friday November 30 at 2pm, at 1313 Sherman Street, Denver and as a business owner you are highly encouraged to attend and show your support of simplification.

Thank you for being a member of the Evergreen Chamber. If you have questions you can call me and I will do my best to answer or connect you with the folks that can.

Sincerely,

Betsy Hays

President/CEO

On September 11, 2018, the Department of Revenue (DOR) adopted emergency rules, effective on December 1, 2018, to provide guidance to retailers and consumers in light of the recent U.S. Supreme Court decision in the S.D. vs. Wayfair case. The DOR will be specifically addressing the Retail Sales Rule, commonly known as the “Sourcing Rule.” Please see attached document from the DOR with additional information about the rule change.

A hearing by the DOR will be held on Friday, November 30, 2018, at 2:00pm at 1313 Sherman Street, Room 220, Denver, CO. 80203 to make the emergency rule permanent. If you are concerned about these rules impacting your business, please plan to attend the hearing or submit comments on the proposed rule. You can submit comments via email to: This email address is being protected from spambots. You need JavaScript enabled to view it.

Comments are due by 5 pm on Nov. 30th.

In your comments, please suggest the DOR consider the following actions:

- DEPT. OF REVENUE SHOULD WORK WITH THE BUSINESS COMMUNITY DOING OUT REACH, SO SMALL BUSINESSES CAN UNDERSTAND THE “SOURCING” RULE CHANGES.

- PER THE ATTACHED OCTOBER 26, 2018 MEMO FROM THE DOR, AN EXTENSION WILL BE ALLOWED TO MARCH 31, 2019 – DOR SHOULD THEREFORE DELAY THE IMPLEMENTATION DATE UNTIL MARCH 31, 2019 FOR ALL BUSINESSES. THEY SHOULD NOT BE IMPLENTING THIS COMPLICATED RULE DURING THE HOLIDAY SELLING SEASON.

- UNTIL THE STATE SIMPLIFIES THEIR FILING SYSTEM WITH A SINGLE POINT OF LICENSING AND REMITTANCE, COLORADO SHOULD NOT PUT EXTRA BURDEN ON COLORADO SMALL BUSINESSES.

- THE LEGISLATIVE SALES TAX SIMPLIFICATION TASKFORCE PLANS TO INTRODUCE LEGISLATION IN 2019 TO PROCEED WITH OBTAINING SOLICITATIONS TO MODERNIZE THE FILING SYSTEM SO THE NEW SOURCING RULE SHOULD WAIT UNTIL AFTER THE MODERNIZATION OF THE DOR FILING SYSTEM.

- THE STATE OF COLORADO IS ONE OF THE FEW STATES THAT HAS NOT SIGNED JOINED THE STREAMLINED SALES TAX EFFORT.

- COLORADO IS KNOWN NATIONALLY FOR HAVING THE MOST COMPLEX COLLECTION AND REMITTANCE OF SALES TAX IN THE UNITED STATES. THIS NEW RULE FURTHER COMPLICATES COLORADO’S COLLECTION AND REMITTANCE PROCESS.

Learn more about Simplify CO Sales & Use Tax Coalition on our website at simplifycosalestax.com/

Sincerely,

Jenn L. Penn

Simplify Colorado Sales & Use Tax Coalition

simplifycosalestax.com/

Our office is located at The Stone House, 1524 Belford Ct., Evergreen, CO 80439

Hours 9:00-4:00, Monday-Friday

303-674-3412

evergreenchamber.org/

Our mission is to grow the local economy by building business and relationships, promoting the community and representing local concerns with our county government.

Please Log in or Create an account to join the conversation.

- Mountain-News-Events

-

- Mountain Legend

-

More at simplifycosalestax.com/The emergency ruling creates a new layer of sales and use tax compliance issues for retailers. These changes will require additional set up and tracking, collection and remittance procedures, and reporting for potentially every business selling in the state.

More importantly, the state isn’t set up to accept the additional reporting. This means filing won’t be as easy as filling out a form on a website confirming destination taxes collected and remitted.

From the Department of Revenue:

www.colorado.gov/pacific/tax/sales-tax-changes

www.colorado.gov/pacific/sites/default/f...es%20-%20Adopted.pdf

My Mountain Town Community Calendar - filter events by Category, date, or keyword to easily find events of interest. Add your community, church, or non-profit event to the calendar yourself! Click here to access the submission form. Businesses: please contact us for more information on adding your events! Questions? Email

Community News, Events, and Calendar Forum - Check here for the latest happenings in our community and add your own!

Please Log in or Create an account to join the conversation.

- Mountain-News-Events

-

- Mountain Legend

-

Extension intended to give businesses more time to comply, legislature time to weigh in

By Joe Rubino | This email address is being protected from spambots. You need JavaScript enabled to view it. | The Denver Post

PUBLISHED: December 6, 2018

The Colorado Department of Revenue announced Thursday it is delaying enforcement on its controversial changes to the state’s sales tax collection rules from March 31 until at least May 31.

Officials hope the added months will give more retailers time to voluntarily comply with the drastically different system and give the the Colorado General Assembly more opportunity to weigh in when the new session convenes in January.

The new regulations, which took informal effect Saturday, require all in-state and out-of-state businesses that ship taxable products to buyers in Colorado to assess, collect and remit sales taxes based on each buyer’s address. It’s a dramatic shift from the way many Colorado retailers did business previously

In a statement Thursday, the [National Federation of Independent Businesses]’s Colorado director, Tony Gagliardi, called the two extra months of breathing room a “welcome holiday present” but expressed concern for what lies ahead when it comes to addressing the state’s highly complex sales tax system.

My Mountain Town Community Calendar - filter events by Category, date, or keyword to easily find events of interest. Add your community, church, or non-profit event to the calendar yourself! Click here to access the submission form. Businesses: please contact us for more information on adding your events! Questions? Email

Community News, Events, and Calendar Forum - Check here for the latest happenings in our community and add your own!

Please Log in or Create an account to join the conversation.

- Mountain-News-Events

-

- Mountain Legend

-

www.simplifycosalestax.com/

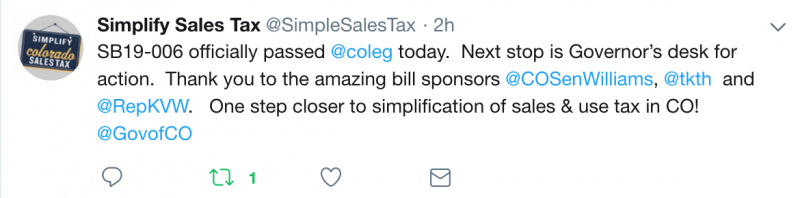

SB19-006 Electronic Sales And Use Tax Simplification System

Bill would simplify Colorado’s confusing sales tax rules

Posted Wednesday, February 20, 2019

A column by State Rep. Tracy Kraft-Tharp (D-Arvada)

In 2013, the Council on State Taxation rated Colorado as the fourth worst state in the country with a grade of “D.”

According to a 2018 analysis by the Council, the score has not improved and Colorado currently has the hardest tax climate for businesses to navigate. The abysmal rankings are a result of a confusing and cumbersome patchwork of 756 geographic areas with different sales tax rates and bases.

Unfortunately, without legislative action, there is more bad news. Colorado is very close to earning an even lower grade due to recent court rulings stemming from the Wayfair case. The case has spurred even more rules, barriers and red tape for Colorado small business. This new set of rules will have a devastating impact on our economy and families across the state.

We can do better. We must do better.

After months of working with Simplify Colorado Sales Tax -- a coalition of business owners dedicated to simplifying the tax code for Colorado -- talking to municipalities, state regulators and attorneys, I’m proud to say that we have a solution in SB 6. Colorado should rank in the top of every poll and every measure. This bill will ensure our tax climate improves.

This bi-partisan effort will have an immediate impact on our tax climate and improve the situation for thousands of small businesses in every jurisdiction of the state.

My Mountain Town Community Calendar - filter events by Category, date, or keyword to easily find events of interest. Add your community, church, or non-profit event to the calendar yourself! Click here to access the submission form. Businesses: please contact us for more information on adding your events! Questions? Email

Community News, Events, and Calendar Forum - Check here for the latest happenings in our community and add your own!

Please Log in or Create an account to join the conversation.

- Mountain-News-Events

-

- Mountain Legend

-

Joey Bunch, Colorado Politics | Feb 7, 2020

Colorado businesses moved a step closer to paying taxes online by hiring vendors to create the website, the coalition behind the effort said Friday.

The Simplify Coalition Sales Tax coalition applauded the Department of Revenue's decision to hire Durango-based MUNIRevs and Oregon-based Transactions Tax Resources.

My Mountain Town Community Calendar - filter events by Category, date, or keyword to easily find events of interest. Add your community, church, or non-profit event to the calendar yourself! Click here to access the submission form. Businesses: please contact us for more information on adding your events! Questions? Email

Community News, Events, and Calendar Forum - Check here for the latest happenings in our community and add your own!

Please Log in or Create an account to join the conversation.

- Forum

- Mountain Classifieds

- Free Business & Member Classifieds

- Changes in CO Dept of Revenue's Emergency Sales Tax Rules. Hearing on Nov 30