- Posts: 7163

- Thank you received: 21

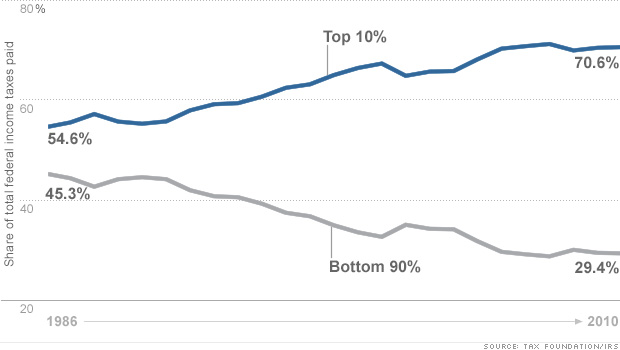

The chart that shows how grossly unfair US Tax System become

- Reverend Revelant

-

- Mountain Legend

-

Here's some tax truth for you...LadyJazzer wrote: You need some new material, Fred... That one is getting tiresome... (Most untrue garbage is...)

The Liberals GOP Twin wrote: Over last 6 years - which company paid most taxes? The answer may surprise you...

http://www.nytimes.com/interactive/2013 ... hare&_r=3&

Question - according to the chart, name a company who paid an effective average tax rate of...

1) 14% _________________________

2) 29.1% _______________________

3) 37%- =>60% _________________________

(hint - question number 3 - big, bad oil)

Times up... please hand in your answers.

References:

http://www.usatoday.com/story/money/per ... s/1991313/

http://dailycaller.com/2013/05/29/nyt-o ... -in-taxes/

Go on... refute that.

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30528

- Thank you received: 179

LadyJazzer wrote: You need some new material, Fred... That one is getting tiresome... (Most untrue garbage is...)

OK, how many times has your President met with his full cabinet this last year?

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- pineinthegrass

-

- Mountain Legend

-

- Posts: 2836

- Thank you received: 25

LadyJazzer wrote: Yes... It IS GROSSLY unfair....

http://www.huffingtonpost.com/2013/05/2 ... 55836.htmlCBO: Tax Breaks Cost $12 Trillion Over Decade, Benefit Most Wealthy

WASHINGTON, May 29 (Reuters) - The top ten U.S. tax deductions, credits and exclusions will keep $12 trillion out of federal government coffers over the next decade, and several of them mainly benefit the wealthiest Americans, a new study from the Congressional Budget Office shows.

The top 20 percent of income earners will reap more than half of the $900 billion in benefits from these tax breaks that will accrue in 2013, the non-partisan CBO said on Wednesday.

Further, 17 percent of the total benefits would go to the top 1 percent of income earners -- families earning roughly $450,000 or more. The same group that was hit with a tax rate hike in January.

The benefits of preferential tax rates on capital gains and dividends, a break worth $161 billion this year, go almost entirely to the wealthy, including 68 percent to the top one percent of earners.

Wow... Imagine my surprise.... :VeryScared:

What is so unfair or surprising?

The top 25% pay 87% of all income taxes so what's unfair about them benefiting from legal exemptions, tax deductions, and credits? The top 20% start at an income threshold of about $102K so many are hardly wealthy. What do you want to do about it? Eliminate tax deductions?

The article complains that the top 1% get 17% of the benefits but the fact is that the top 1% pay 37% of all income tax. What's surprising that they benefit from deductions? If anything, I'm surprised they don't benefit nearly as much as they pay percentage wise.

We know that nearly 50% of income earners pay zero income tax, so it only follows that the top 50% of income earners will get most all the benefits of any tax deductions they are allowed. How is someone who pays zero income tax supposed to get equal benefits for tax exemptions, deductions, and credits? Well, they do get benefits, but not as much.

The federal income tax is actually a very progressive tax and it has gotten more and more progressive over the last 25-30 years.

http://money.cnn.com/2013/03/12/news/economy/rich-taxes/index.html

http://www.ntu.org/tax-basics/who-pays-income-taxes.html

Please Log in or Create an account to join the conversation.

- Reverend Revelant

-

- Mountain Legend

-

- Posts: 7163

- Thank you received: 21

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.

- PrintSmith

-

- Mountain Legend

-

- Posts: 5749

- Thank you received: 40

The top 20% of income earners are already paying in excess of 80% of all income taxes. That 50% of the benefits from tax deductions and credits are received by them still leaves them receiving less benefit from the tax code than their contributions in tax revenue represent.

The "preferential tax rates" on capital gains (money that is taxed as individual income after those same people have already paid an income tax on it at the corporate level to the federal government) will cost the general treasury roughly half of what the tax credit for employer paid health contributions will according to the article you provided a link to. That particular credit, by the by, benefits the holders of 401Ks and IRAs that are invested as equally as it benefits the top 20% income bracket. If more of a benefit is realized by the top 20%, it is because they have more money invested, not because those who have less invested are paying a higher rate. So to pretend that this tax rate is preferential absured on its face.

Tax deductions for charitable contributions benefit the wealthiest the most because, surprise, surprise, just like investing, they contribute the most to charity. That charity, a voluntary surrender of the fruits of one's efforts as opposed to the involuntary surrender imposed by taxation, isn't taxed because those who receive the charity realize the benefit from that income, not the person who donated the income to the charity. Again, if a greater benefit is realized it is because more of the fruits of their efforts are donated to charitable causes.

The rest is similarly bogus, beginning with the actual headline of the story itself. Tax credits and tax deductions cost the federal government nothing because they are not purchasing anything. To say that the credits and deductions cost the federal government anything is a farce to begin with. Buying votes with individual welfare expansion costs the federal government something, aircraft carriers cost the federal government something. Money that is never required to be submitted to the treasury is not a cost of government.

Please Log in or Create an account to join the conversation.