- Posts: 30755

- Thank you received: 179

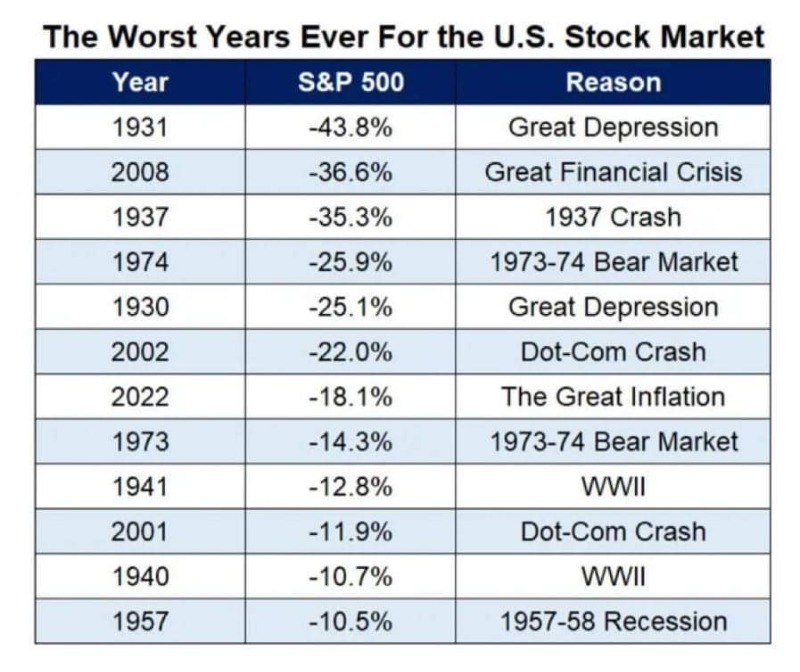

Biden Stock Market Crash

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- ramage

-

- Mountain Legend

-

- Posts: 4388

- Thank you received: 94

The Federal Reserve evidently felt that Slo Joe was not Obama and began to ratchet up interest rates. No more free money, the markets went into a swoon, but that did not stop the Administration from spending money. ( We spend $399 billion to service this debt. )

So we now have inflation and rising interest rates.

Ironically, like President Trump, I will pay no income tax due to market losses exceeding income. I don't find that to be comforting.

Please Log in or Create an account to join the conversation.

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 30755

- Thank you received: 179

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- homeagain

-

- Mountain Legend

-

- Posts: 12791

- Thank you received: 173

Please Log in or Create an account to join the conversation.

- ramage

-

- Mountain Legend

-

- Posts: 4388

- Thank you received: 94

No.

An accountant can help with regard to losses carried forward, can do nothing to negate actual losses in the market.

Please Log in or Create an account to join the conversation.

- Blazer Bob

-

- Mountain Legend

-

- Posts: 10451

- Thank you received: 70

That refers to the # of dependents claimed for withholding.

Please Log in or Create an account to join the conversation.

- Rick

-

- Mountain Legend

-

- Posts: 15593

- Thank you received: 163

The left is angry because they are now being judged by the content of their character and not by the color of their skin.

Please Log in or Create an account to join the conversation.

- homeagain

-

- Mountain Legend

-

- Posts: 12791

- Thank you received: 173

How can we remodel the U.S. tax system to prevent Trump and other wealthy tax cheats from continuing to make a mockery of it? And, going beyond the individual case, egregious as it is, how can we use what we have learned to make the tax system fairer?

After reviewing years of Trump’s returns and speaking with independent tax experts, I am convinced that there are three imperatives. First, we need to strengthen the Internal Revenue Service so that it has the

capacity to hold accountable serial tax avoiders like Trump and to deter would-be imitators. Second, we must eliminate loopholes in the tax code that serve no economic purpose beyond sheltering the riches of

the financial élite while depriving the federal government of much-needed revenue that would aid other Americans. (This shortfall amounts to upward of four hundred billion dollars a year, according to some estimates.) Third, we have to introduce broader changes to the tax code for an economic era where the rich accumulate vast amounts of untaxed wealth, and where inequality has reached record levels.

AS I have stayed before.......change the paradigm,close the loopholes...NOT THAT THIS WILL BE ACCOMPLISHED ANYTIME SOON.

Please Log in or Create an account to join the conversation.

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 30755

- Thank you received: 179

And loopholes is incorrect. The law is written that way so it isn't a loophole. It is the tax code.

And if you tax people who lose money making investments, capital will flow from the US to nations that refuse to penalize risk takers.

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- Blazer Bob

-

- Mountain Legend

-

- Posts: 10451

- Thank you received: 70

AND NOW YOU ARE DOWN TO LOOSERS WHING ABOUT LOOPHOLES.

homeagain wrote: www.newyorker.com/news/our-columnists/ho...b2fdc7b5ac4cd8&esrc=

How can we remodel the U.S. tax system to prevent Trump and other wealthy tax cheats from continuing to make a mockery of it? And, going beyond the individual case, egregious as it is, how can we use what we have learned to make the tax system fairer?

After reviewing years of Trump’s returns and speaking with independent tax experts, I am convinced that there are three imperatives. First, we need to strengthen the Internal Revenue Service so that it has the

capacity to hold accountable serial tax avoiders like Trump and to deter would-be imitators. Second, we must eliminate loopholes in the tax code that serve no economic purpose beyond sheltering the riches of

the financial élite while depriving the federal government of much-needed revenue that would aid other Americans. (This shortfall amounts to upward of four hundred billion dollars a year, according to some estimates.) Third, we have to introduce broader changes to the tax code for an economic era where the rich accumulate vast amounts of untaxed wealth, and where inequality has reached record levels.

AS I have stayed before.......change the paradigm,close the loopholes...NOT THAT THIS WILL BE ACCOMPLISHED ANYTIME SOON.

Please Log in or Create an account to join the conversation.