- Posts: 30729

- Thank you received: 179

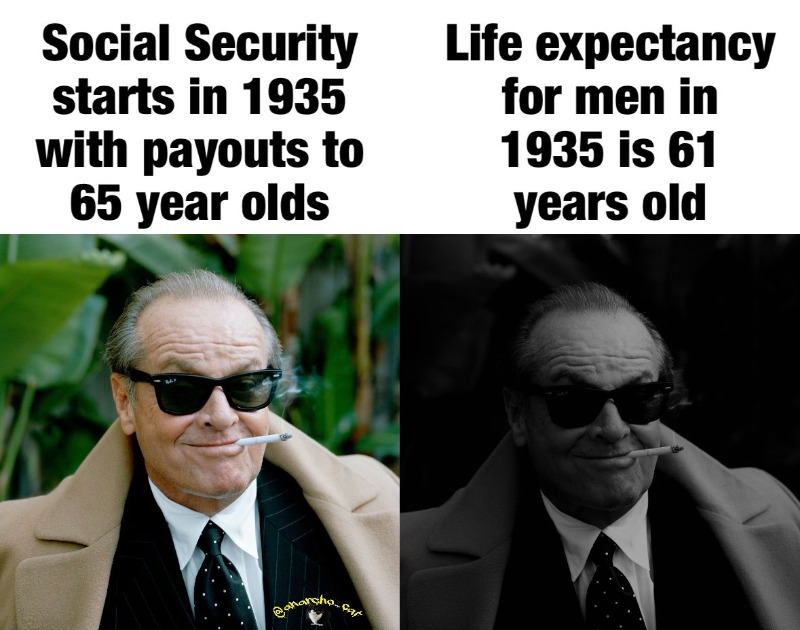

Social Security Going Bankrupt?

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

Less

More

22 Mar 2025 14:58 #1

by FredHayek

Thomas Sowell: There are no solutions, just trade-offs.

Social Security Going Bankrupt? was created by FredHayek

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- FredHayek

-

Topic Author

Topic Author

- Mountain Legend

-

Less

More

- Posts: 30729

- Thank you received: 179

23 Mar 2025 16:05 #2

by FredHayek

Thomas Sowell: There are no solutions, just trade-offs.

Replied by FredHayek on topic Social Security Going Bankrupt?

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- PrintSmith

-

- Mountain Legend

-

Less

More

- Posts: 5759

- Thank you received: 40

25 Mar 2025 15:54 #3

by PrintSmith

Replied by PrintSmith on topic Social Security Going Bankrupt?

And here's the kicker folks . . . the "Trust Fund" IOUs are money the federal government owes to itself. The federal government was both the lender and the lendee. To redeem that IOU, since the federal government is operating at a deficit, requires that the federal government sell a Treasury Note or other debt instrument to "pay back" Social Security, which means that the debt is going from internal ownership to external ownership.

And I can all but guarantee you that the interest they have to pay to an external owner of the debt is more than they were paying internally, which also means that the debt has to be refinanced, from time to time, at current rates, which is why servicing the federal debt now costs more than the Department of Defense in the federal budget every year. Most of that increase is refinanced debt, at current rates, when the initial cost to borrow that money was next to nothing. As more and more of the debt that was incurred, or refinanced, in the 0.5% interest days comes up for renewal, the cost of refinancing that debt has risen to over 4%, more than 8x the rate paid when it was last refinanced or incurred 10 years ago.

And I can all but guarantee you that the interest they have to pay to an external owner of the debt is more than they were paying internally, which also means that the debt has to be refinanced, from time to time, at current rates, which is why servicing the federal debt now costs more than the Department of Defense in the federal budget every year. Most of that increase is refinanced debt, at current rates, when the initial cost to borrow that money was next to nothing. As more and more of the debt that was incurred, or refinanced, in the 0.5% interest days comes up for renewal, the cost of refinancing that debt has risen to over 4%, more than 8x the rate paid when it was last refinanced or incurred 10 years ago.

Please Log in or Create an account to join the conversation.

Time to create page: 0.151 seconds