- Posts: 6722

- Thank you received: 72

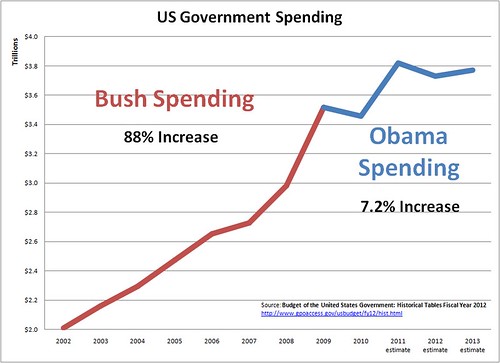

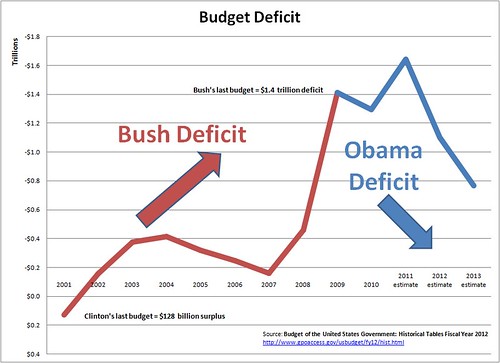

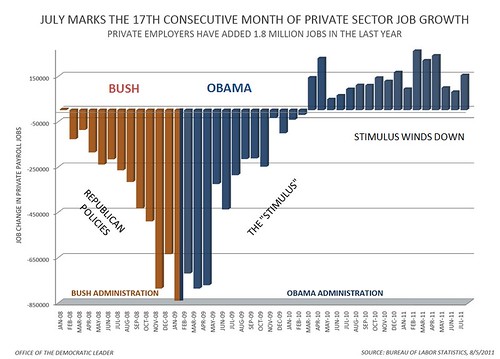

Three Charts to Email to Your Right-Wing Brother-In-Law

- Wayne Harrison

-

Topic Author

Topic Author

- Mountain Legend

-

- BearMtnHIB

-

- Mountain Legend

-

- Posts: 2464

- Thank you received: 0

It's not right to spread lies - those charts are more phoney than a 3 dollar bill.

Nice try though.

Please Log in or Create an account to join the conversation.

- Wayne Harrison

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 6722

- Thank you received: 72

You didn't give a source for your claim.

Please Log in or Create an account to join the conversation.

- PrintSmith

-

- Mountain Legend

-

- Posts: 5760

- Thank you received: 40

Please Log in or Create an account to join the conversation.

- Wayne Harrison

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 6722

- Thank you received: 72

Please Log in or Create an account to join the conversation.

- UNDER MODERATION

-

- Visitor

-

Good stuff

Please Log in or Create an account to join the conversation.

- PrintSmith

-

- Mountain Legend

-

- Posts: 5760

- Thank you received: 40

What caused the problem in the first place was government policies. You know, the ones that required 50% of every loan purchased by Fannie and Freddie to be to low income families or in areas of community redevelopment and also require fair lending practices? If they will lend to a low income family with only 5% down, or finance 100% of the purchase, but won't do the same for a middle or high income family, doesn't that fall crosswise of fair lending practices? Add in some wonderful government accounting rules and regs put into place in the wake of Enron and Qwest. Add to that the private profit driven nature of Fannie and Freddie and the federal guarantees on the mortgage securities they issue and what other result would you expect other than a bubble that would quickly inflate and burst?WayneH wrote: If you get tricked into thinking that Obama has made things worse and that we should go back to what we were doing before Obama -- tax cuts for the rich, giving giant corporations and Wall Street everything they want -- when those are the things that caused the problems in the first place, then we will be in real trouble.

Here again the problem is government, not too little of it, too much of it. Fannie and Freddie were made into GSE's because they were losing too much money when LBJ was in the midst of trying to provide guns and butter, but the taxpayers were still the ones guaranteeing private industry against loss from what they purchased from Fannie and Freddie. The federal government was the one using that leverage to require 50% of what Fannie and Freddie bought be loans made to low income families. Fannie and Freddie were losing market share, ie profits, to other institutions, so they entered the subprime market, bundled together bums and plums, and sold mortgage securities to other financial institutions, which were guaranteed with the full faith and credit of the federal government. Naturally when those subprime loans started defaulting, and federal accounting rules dictated that the securities, which the institutions were using as assets since they were guaranteed, be removed from the ledgers, the loss of those assets from the books put them in violation of federal lending requirements that made them have $X in assets for every $Y in loans. Since the securities were guaranteed with the full faith and credit of the US federal government, allowing those securities and their derivatives to default would have been a selective default of the federal government itself.

Wasn't the "progressive" argument about why the TEA Party was so bad rooted in the premise that it would cause the first ever default of the federal government, which would harm the economy and cause all of the debt we had to go up in price to finance? Wouldn't that be precisely what would have happened without the passage of TARP? Isn't that why the TARP legislation allotted up to $800 billion to cover the guarantees of the federal government on the Fannie and Freddie issued securities? Isn't that why Fannie and Freddie received more TARP money than all the other financial institutions combined?

Please Log in or Create an account to join the conversation.

- UNDER MODERATION

-

- Visitor

-

What about that don't you understand?

Why would you want to double down on it? Are you an idiot or something?

Please Log in or Create an account to join the conversation.

- PrintSmith

-

- Mountain Legend

-

- Posts: 5760

- Thank you received: 40

Please Log in or Create an account to join the conversation.

- UNDER MODERATION

-

- Visitor

-

Imperial statistical data over the last 50 years paints a different picture my friend. First lets get you into reality, then we'll go from there

Please Log in or Create an account to join the conversation.