- Posts: 2836

- Thank you received: 25

Taxes, taxes, and more taxes!

- pineinthegrass

-

Topic Author

Topic Author

- Mountain Legend

-

"I can make a firm pledge. Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes."

[youtube:zb4lhrzc][/youtube:zb4lhrzc]

Well, that pledge was already broken with the new taxes in the Obamacare bill. And now we have his latest tax increases proposed in his new jobs bill:

Raise the 33% tax bracket to 36% and the 35% bracket to 39.6% for those making over $250K.

Increase long term capital gains rate from 15% to 20% (I think it's for all taxpayers, but it's not clear in the link below).

Phase out the personal exemption and limit itemized deductions based on income. This is probably a reinstatement of the Bush #1 "read my lips" tax increase. So he not only wants to take away Bush #2's tax cuts, he wants to add Bush #1's tax increase.

Triple airline security fees from $5 to $15 for each flight.

Tax federal workers another 1.2% for pensions.

Charge military retirees $200 at age 65 for Medicare expenses and charge them more for non generic drugs (I guess in Obama's world military retirees are rich and don't pay their fair share).

Charge corporate jet owners $100 for each flight.

Increase by .1% the fee charged by Fannie Mae and Freddie Mac on mortage loans. This would increase a homeowner's yearly cost for his loan by an average of $180 each year (I guess to keep his pledge, the Obama plan is to make it so only those making over $250K can afford a home).

http://finance.yahoo.com/news/New-government-fees-pepper-apf-4120540659.html?x=0&.v=2

http://www.huffingtonpost.com/2009/02/26/obama-wants-higher-capita_n_170237.html

But wait, there's more!

Each taxpayer will receive a brand new Obamco Effamatic! It slices and dices taxpayers, but cuts nothing.

Please Log in or Create an account to join the conversation.

- archer

-

- Mountain Legend

-

- Posts: 9964

- Thank you received: 8

Please Log in or Create an account to join the conversation.

- Nmysys

-

- Mountain Legend

-

- Posts: 4563

- Thank you received: 0

Please Log in or Create an account to join the conversation.

- The Boss

-

- Mountain Legend

-

- Posts: 1688

- Thank you received: 0

I don't see how one can tax each corp flight? Is that not a private affair, accepting that accepts not only the logic that one could tax each one of your car trips (an ignition tax say), but that in order to do so, you will have to log each trip with the fed, in fact perhaps need a permit and in order to get the permit, a reasonable amount of time, say 30 days must be given for approval....so that is why everyone making less than $250,000 a year should not want such a tax....just like those that want a private relationship with their doctor should be up in arms every time they mess with the doctor relationship for MMJ patients...people need to wake up before they jump into the slip and slide...it is slick and only flows in one direction. Why is this always missed?

But we all know that MASSIVE tax increases and MASSIVE service reductions are coming. Perhaps it would be better if we debate where to increase taxes and decrease services. Can the lefties and righties on this board each suggest 3 services to cut and three taxes to increase facing up to these $ facts? Even one of each?

I suggest reducing safety enforcement that involves going in other people's homes (like building codes) while increasing a tax on children (like a poll tax)....there I did it

Please Log in or Create an account to join the conversation.

- otisptoadwater

-

- Mountain Legend

-

- Posts: 7923

- Thank you received: 70

So far the "just pass this bill" approach seems to be Barry's strategy; so far that has not worked but he continues to go back to the same solutions. Draft another bill that looks nice on the surface, don't publish any of the actual details until the last moment and then insist that congress pass the bill without any debate or time to actually read the bill and understand what the proposed changes really mean. Doing the same thing over and over but expecting a different result is tantamount to insanity...

I can explain it to you but I can't understand it for you.

"Any man who thinks he can be happy and prosperous by letting the Government take care of him; better take a closer look at the American Indian." - Henry Ford

Corruptissima re publica plurimae leges; When the Republic is at its most corrupt the laws are most numerous. - Publius Cornelius Tacitus

Please Log in or Create an account to join the conversation.

- BearMtnHIB

-

- Mountain Legend

-

- Posts: 2464

- Thank you received: 0

Perhaps if they had some skin in the game- and actually were included in the game, they could understand that the best producers also pay the lions share of the taxes already. Demanding more from them in order to feed an obese government will not help anything- in fact is will result in less economic activity, less investment- and fewer dollars in the private sector, and at the same time feeding the monster that got us into this trouble in the first place.....

Government spending!

What can we cut?

Department of education

Welfare and Food stamps

Most of the IRS can be eliminated by reforming the tax code

Stop bailing out failed corporations

Countless regulations can be cut & eliminated

Scale everything else back to within what the current economy can support

Please Log in or Create an account to join the conversation.

- Pony Soldier

-

- User is blocked

-

- Posts: 4749

- Thank you received: 43

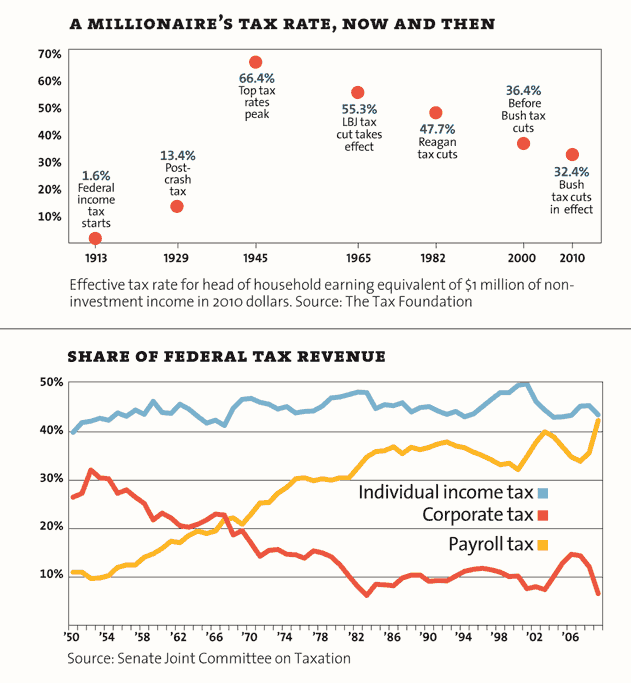

As you can see by this chart, corporate taxes have decreased while payroll taxes have made up the difference. Now you want to cut the social services that we pay for to bankroll the corporate tax cuts that have taken place. One question - where are the promised jobs that have come from all of those corporate tax cuts?

Please Log in or Create an account to join the conversation.

- pineinthegrass

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 2836

- Thank you received: 25

towermonkey wrote:

As you can see by this chart, corporate taxes have decreased while payroll taxes have made up the difference. Now you want to cut the social services that we pay for to bankroll the corporate tax cuts that have taken place. One question - where are the promised jobs that have come from all of those corporate tax cuts?

I'd appreciate a link for where you got those graphs.

Both graphs are confusing to me. The first one shows the effective tax rate paid by millionaires, but leaves out investment income (capital gains, dividends). Why would they do that since that would be a very significant part of a millionaire's income (just ask Warren Buffett)? So the first graph really doesn't show the total effective tax rate they paid.

It only goes back to 1979, but here is a chart that shows total effective tax rates paid. For the top 1% of earners, it's run pretty consistently around 20% (federal income tax) regardless of what tax brackets (or top bracket) were in effect at the time. So when people say the top bracket used to be at 70% or 50% in the late 70's and early 80's, it didn't really effect what people actually paid. There used to be more loopholes back then.

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=456

The second graph is very confusing to me. It doesn't show the actual tax rates, but the percentage each type of tax contributes to total federal revenue. So if one tax collects more, it would tend to pull the other two down. That makes it tough to understand what's really going on.

And technically, payroll taxes shouldn't be on there because they are supposed to pay for only Social Security and Medicare. But that's not how it works now. Still, I don't understand how payroll taxes are contributing more and more. At first I thought it would be due to a growing population, but that should make income tax revenue go up as well. I can't recall any major increases in payroll tax rates other than they first got taxed at 50% around 1983 and later taxed at 85% in 1994 (or close to that year). But that should of increased income tax revenue, not payroll tax revenue.

What am I missing here?

Please Log in or Create an account to join the conversation.

- pineinthegrass

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 2836

- Thank you received: 25

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=45

Please Log in or Create an account to join the conversation.

- Wayne Harrison

-

- Mountain Legend

-

- Posts: 6722

- Thank you received: 72

Please Log in or Create an account to join the conversation.