- Posts: 2464

- Thank you received: 0

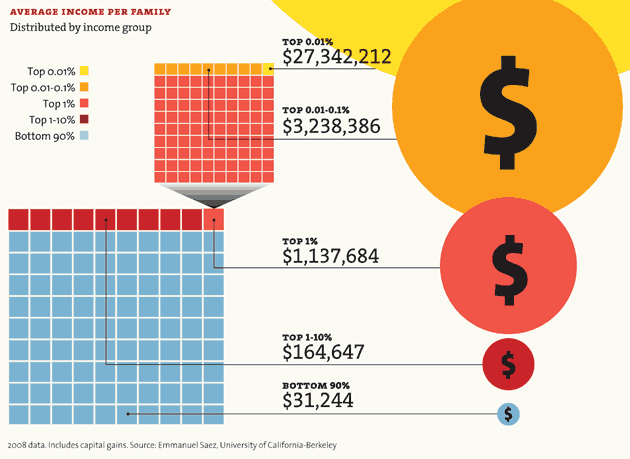

The rich are different — and not in a good way...

- BearMtnHIB

-

- Mountain Legend

-

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

Bush is still getting blamed because Bush DID IT and the mess left behind was HIS....

Deal with it.

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30869

- Thank you received: 179

LadyJazzer wrote: Yeah, and we were told George W. Bush was a good president...

After two unnecessary, unpaid for wars, $700 Billion of unfunded Medicare plans, only 3million jobs created in 8 years, the worst recession since the Great Depression of 1929, a job-loss rate of 800,000/month, a TARP and Bank Bailout program that he signed, and increase in the national debt of how many trillions?... I guess you can't always believe what you hear, can ya....?

Guess we will see whose spin is judged correct in 14 months.

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- PrintSmith

-

- Mountain Legend

-

- Posts: 5760

- Thank you received: 40

So you specify income taxes in your first paragraph, and note all the other taxes that those not paying federal income taxes actually pay, and then completely abandon that logic in your second paragraph to assert that people who can afford good CPA's pay no taxes at all. Consistency would be nice for a change LJ. Don't those folks with CPA's pay sales taxes, property taxes, state taxes, county taxes, fuel taxes, privilege to be employed/have employee taxes? Of course they do - in larger amounts than the other folks do because they own more valuable property, earn more dollars in income and, particularly if they are the employers of those who earn less, match every dollar of privilege taxes that their employees pay in addition to 100% of their own privilege taxes.LadyJazzer wrote: Not having a "FEDERAL income tax liability" is NOT THE SAME THING as "not paying any taxes"... Taxes are paid, credits and deductions are taken AT THE FEDERAL LEVEL, which, if you are in the lowest income group, sometimes results in a zero tax-liability. That doesn't mean they don't pay sales taxes, property taxes, state taxes, county taxes, fuel taxes, etc...

On the other hand, we have millionaires who, because they can afford good CPA's, earn MILLIONS and pay no taxes on it. Then you jump to the silly-assed conclusion that because they earn millions, they "create jobs"... I call bullsh*t... The number of them that DO create jobs is on the order of 4%...

Now, Hickenlooper may indeed be paying less in property taxes in Park County because he took advantage of a tax loophole, but he pays the same rate on his city residence as everyone else does in that county, which is probably a fairly expensive house, which means he pays more in taxes than someone living in your basic suburban tract housing. He pays the same vehicle registration fees - probably on more vehicles as well as on more expensive vehicles, which means he pays more in taxes there. He buys more expensive meals at restaurants, so more taxes there. Drinks more expensive bottles of wine, so more taxes there. I'm betting the sound system and visual display in his home is light years beyond what I have, which means it was more expensive to purchase, which means he paid more in taxes on his system than I did on mine.

As to creating jobs, I'm betting that Paris Hilton's spending habits keep a fairly good number of people employed. Sales staff in the stores she frequents, lawyers trying to keep her sorry backside out of jail, waiters and waitresses, chefs, janitorial staff for her building as well as maid service for her home, drivers, cabbies, a groomer for her canine companions, her own hair stylist, airline tickets to fly to Paris to shop for the afternoon, vacations - every dollar of her inheritance that she spends like money is going out of style supports employment, in other words, it creates and saves jobs. I'm sure she also hires directly, at the very least a personal secretary, I'm sorry, administrative assistant, which means she is responsible for creating at least one job. She also likely has hired help living at each of her residences full time, which account for a few more jobs she created. As much as she may be disliked by you, I'm betting she has created more employment, directly and indirectly, than your average middle class income person has.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

Please Log in or Create an account to join the conversation.

- Pony Soldier

-

- User is blocked

-

- Posts: 4749

- Thank you received: 43

BearMtnHIB wrote:

AspenValley wrote:

SS109 wrote:

towermonkey wrote: So many people define themselves based on what they do for a living or their net worth. That is not who you are, it is what you do. People have forgotten how to live.

But the Left will continue to villify people for being successful. Even if they do create more jobs than the poor.

Thinking a person who earns more should pay more in taxes is not "vilifying".

Time for another installment of "educate the commie".

News flash- people who earn more DO already pay more taxes, in fact - the most productive earners are supporting all the deadbeats- which is about half of the country! Yes- half the country are tax freeloaders, sponging off of the producers.

What you are actually saying is that you want to further penalize productive workers until there is no more incentive to be a top earner. Don't deny it- if this was just about paying more if you earn more- then you would just shut your big fat trap- because those who earn more already pay more- by a long shot too!

See- people like you dont think that 40.4% of all the taxes being paid by the top 1% of earners is enough. Or that the top 5% pay 70% of all the income taxes collected! Yea- 70%. You want more.

Being the compassionate person I am- I'd like to see those top producers left alone- or give um a break since they have been covering for the dead ass lazy people for so long. Lets get the deadbeats to pay their share for once!!

Yep, those poor rich folks shouldn't have to part with a dime.

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30869

- Thank you received: 179

LadyJazzer wrote: Yeah, and we were told George W. Bush was a good president...

After two unnecessary, unpaid for wars, $700 Billion of unfunded Medicare plans, only 3million jobs created in 8 years, the worst recession since the Great Depression of 1929, a job-loss rate of 800,000/month, a TARP and Bank Bailout program that he signed, and increase in the national debt of how many trillions?... I guess you can't always believe what you hear, can ya....?

Once again, conservative Republicans voted against TARP.

Bush, a RINO?

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

Please Log in or Create an account to join the conversation.

- Residenttroll returns

-

- Mountain Legend

-

- Posts: 4630

- Thank you received: 0

Heck if democrats support unions who have a flat income tax (I mean't member fee) on a members payroll without any deductions, credits, or loop holes....why can't the democrats support a federal income flat tax?

Please Log in or Create an account to join the conversation.