- Posts: 14880

- Thank you received: 27

June Jobs Report

- LadyJazzer

-

- Mountain Legend

-

http://www.csg.org/pubs/capitolideas/en ... e83_3.aspxState Government Employment

Change in State Government Employment by State:

All employees: Government Jobs

State and Local Government Payrolls are shrinking

Annual Change in Government Employment 1939 to 2011

(Interesting...Look at the numbers from 2000 to 2008; then look at 2008-2011...) Hmmmmmm

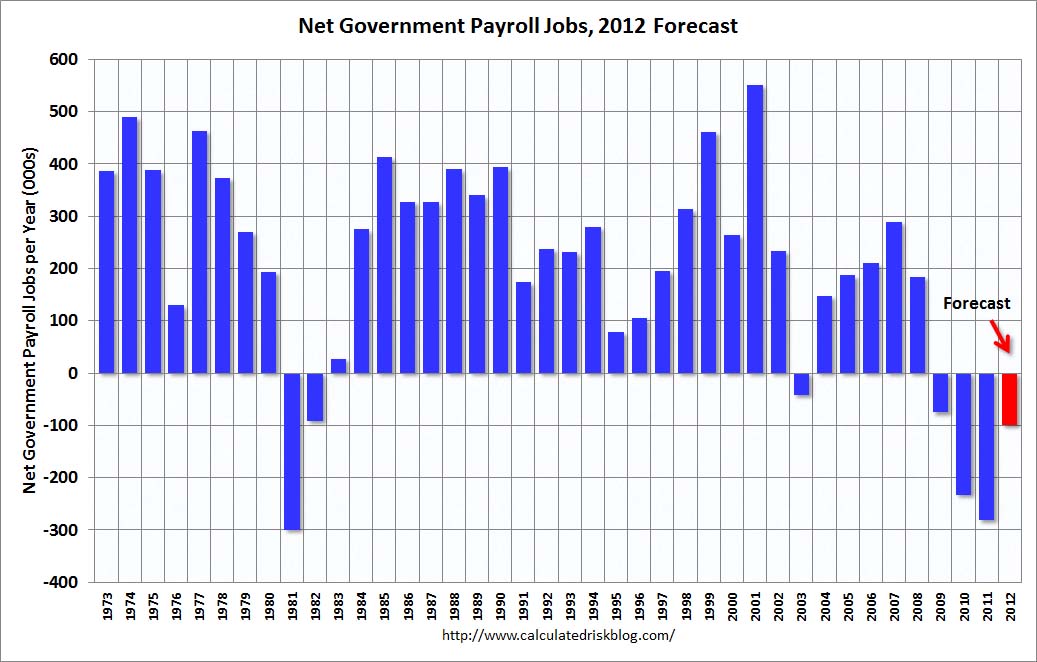

Net Government Payroll Jobs: 1973 to 2012

Some are State only; some are State/Local; some are ALL GOVERNMENT... Gee, isn't it interesting...They're all headed in the same direction...

I could care less about your anti-tax/anti-government/teabagger garbage... These are people who are losing their jobs, just like the rest of the citizens.

Please Log in or Create an account to join the conversation.

- BearMtnHIB

-

- Mountain Legend

-

- Posts: 2464

- Thank you received: 0

That's just a tiny drop in the bucket compared to the millions that need to go away so the middle class can get enough oxygen to breath again.

Your charts don't mean much at all.

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30535

- Thank you received: 179

If they doubled the price on gas, think people would buy smaller cars? Take fewer trips? Carpool more?

Why do liberals believe that sin taxes can change behavior, for example, cigarette smoking has gone down after taxes went up, but it won't affect how people earn income? I realize it is less elastic than other taxes, but people do change in response.

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

And your generalizations and baseless charges don't mean much at all either.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

FredHayek wrote: ...but taxes rate changes don't have consequences, they can't...

If they doubled the price on gas, think people would buy smaller cars? Take fewer trips? Carpool more?

Why do liberals believe that sin taxes can change behavior, for example, cigarette smoking has gone down after taxes went up, but it won't affect how people earn income? I realize it is less elastic than other taxes, but people do change in response.

Yes, that's why we had 23.1 million jobs created over 8 years with the old tax-rates for EVERYONE (that were 3.9% more than they are now), and why dropping them 3.9% for the 8 years of Bush created only 3 million jobs and gave us the worst recession since the Great Depression. I can see your point..........Not.

Please Log in or Create an account to join the conversation.

- BearMtnHIB

-

- Mountain Legend

-

- Posts: 2464

- Thank you received: 0

Gee- I wonder what Maryland could have done with that $1.7 billion they lost - because they had a bunch of looters in charge- maybe build some roads, hire some teachers or cops- I hear the dropout rate is pretty high there, and the crime rate is up.The Change Maryland study found that the tax cost Maryland $1.7 billion in lost tax revenues.

The old tried and true rule still applies- that which you want more of - you tax less...

And that which you want less of - you tax more of.

Maryland proves this rule once again- more taxes lead to less economic activity, and fewer revenues collected.

Maryland wanted less rich people- and that's what they got.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

Please Log in or Create an account to join the conversation.

- mtntrekker

-

- User is blocked

-

- Posts: 1485

- Thank you received: 0

BearMtnHIB wrote: The old tried and true rule still applies- that which you want more of - you tax less...

And that which you want less of - you tax more of.

I get the impression that even though this has been mentioned time and time again some people just don't get it. Putting the economy in the toilet using Obuma methods and then saying he hasn't had enough time seems to be all they can understand.

bumper sticker - honk if you will pay my mortgage

"The problem with Socialism is that eventually you run out of other people's money." attributed to Margaret Thatcher

"A wise and frugal government, which shall leave men free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned - this is the sum of good government." Thomas Jefferson

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30535

- Thank you received: 179

Democracy4Sale wrote:

FredHayek wrote: ...but taxes rate changes don't have consequences, they can't...

If they doubled the price on gas, think people would buy smaller cars? Take fewer trips? Carpool more?

Why do liberals believe that sin taxes can change behavior, for example, cigarette smoking has gone down after taxes went up, but it won't affect how people earn income? I realize it is less elastic than other taxes, but people do change in response.

Yes, that's why we had 23.1 million jobs created over 8 years with the old tax-rates for EVERYONE (that were 3.9% more than they are now), and why dropping them 3.9% for the 8 years of Bush created only 3 million jobs and gave us the worst recession since the Great Depression. I can see your point..........Not.

You see Obama as a savior, when he is just Bush-lite. In fact today, he changed his mind again and declared that he wants to only bring back some Clinton tax hikes.

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

In fact, Mutt_Rimmer was paying only 14.9%, and the only thing it appears he created was more offshore accounts in the Caymans, Switzerland, Bermuda, and a few jobs for car-elevator installers.

Please Log in or Create an account to join the conversation.