- Posts: 7163

- Thank you received: 21

IRSS (Internal Revenue Schutzstaffel) Gruppen news summary

- Reverend Revelant

-

Topic Author

Topic Author

- Mountain Legend

-

http://www.c-span.org/

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.

- MountainRoadCrew

-

- Mountain Advisor

-

- Posts: 296

- Thank you received: 3

Please Log in or Create an account to join the conversation.

- Blazer Bob

-

- Mountain Legend

-

- Posts: 10451

- Thank you received: 70

[youtube:652ifwgy][/youtube:652ifwgy]

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30727

- Thank you received: 179

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- Reverend Revelant

-

Topic Author

Topic Author

- Mountain Legend

-

- Posts: 7163

- Thank you received: 21

House Oversight Cmte. Examines IRS Spending Practices

http://www.c-span.org/

Of course... Dog says don't watch it... it's only political theatre.

Waiting for Armageddon since 33 AD

Please Log in or Create an account to join the conversation.

- Blazer Bob

-

- Mountain Legend

-

- Posts: 10451

- Thank you received: 70

FredHayek wrote: The IRS is unable to find all the receipts for their expensive team building exercises. Justice?

I did not know you were being literal. This is rich.

"The Treasury Department's audit of the Internal Revenue Service's 225 employee conferences that cost taxpayers nearly $50 million might not be accurate or include all of the IRS expenses because the agency that daily demands records from taxpayers didn't supply all the receipts sought by the investigators."

http://washingtonexaminer.com/audit-irs ... le/2531115

Please Log in or Create an account to join the conversation.

- FOS

-

- Mountain Legend

-

- Posts: 2050

- Thank you received: 0

Maybe I will just keep 90% of my receipts.

Please Log in or Create an account to join the conversation.

- LadyJazzer

-

- Mountain Legend

-

- Posts: 14880

- Thank you received: 27

http://www.huffingtonpost.com/2013/06/0 ... 96998.htmlIRS Approved More Conservative Groups Than Liberal Groups Selected For Review: Report

An analysis of a list of groups approved for tax exempt status, released by the Internal Revenue Service in the wake of its admission to targeting conservative groups for heightened scrutiny, determined that of the groups approved, more than two-thirds were conservative.

The analysis, by Martin A. Sullivan of Tax Analysts, examined a list of 176 advocacy organizations that were ultimately approved for tax exempt status by the IRS during the period when the service admits to having targeted certain conservative groups with inappropriate criteria.

According to Sullivan's analysis, 122 of the groups were conservative, 48 were liberal or non-conservative and 6 remain of unidentified ideology.

The IRS released the list on May 15, after senior official Lois Lerner announced that the IRS had been inappropriately targeting conservative groups in its review of groups seeking tax exempt status for political activity.

Well, dang... So, let me get this straight...There were roughly 60% MORE right-wing groups that got approved for a FREE-RIDE on the TAXPAYERS, than liberal groups....

Got it...

Please Log in or Create an account to join the conversation.

- FredHayek

-

- Mountain Legend

-

- Posts: 30727

- Thank you received: 179

Thomas Sowell: There are no solutions, just trade-offs.

Please Log in or Create an account to join the conversation.

- pineinthegrass

-

- Mountain Legend

-

- Posts: 2836

- Thank you received: 25

LadyJazzer wrote: On, NO!...ANOTHER OUTRAGE....

http://www.huffingtonpost.com/2013/06/0 ... 96998.htmlIRS Approved More Conservative Groups Than Liberal Groups Selected For Review: Report

An analysis of a list of groups approved for tax exempt status, released by the Internal Revenue Service in the wake of its admission to targeting conservative groups for heightened scrutiny, determined that of the groups approved, more than two-thirds were conservative.

The analysis, by Martin A. Sullivan of Tax Analysts, examined a list of 176 advocacy organizations that were ultimately approved for tax exempt status by the IRS during the period when the service admits to having targeted certain conservative groups with inappropriate criteria.

According to Sullivan's analysis, 122 of the groups were conservative, 48 were liberal or non-conservative and 6 remain of unidentified ideology.

The IRS released the list on May 15, after senior official Lois Lerner announced that the IRS had been inappropriately targeting conservative groups in its review of groups seeking tax exempt status for political activity.

Well, dang... So, let me get this straight...There were roughly 60% MORE right-wing groups that got approved for a FREE-RIDE on the TAXPAYERS, than liberal groups....

Got it...

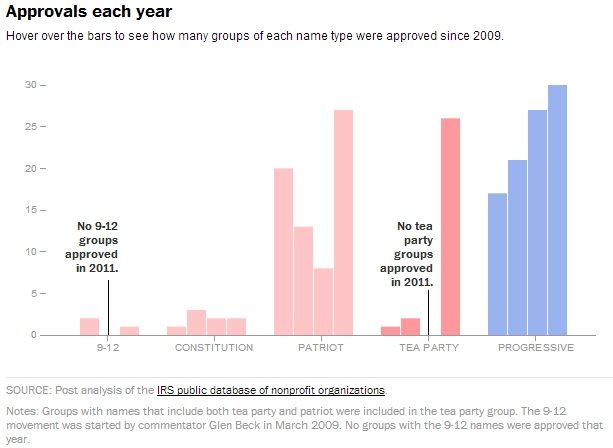

That doesn't seem to match what the Washington Post found. Different criteria?

IRS targets conservative groups

By Dan Keating and Darla Cameron, Published: May 15, 2013

The IRS grants tax-exempt status to 40,000 nonprofit groups per year. When the IRS began targeting conservative groups' applications in 2011, nonprofit approvals for groups with

tea party or 9-12 in their name stopped entirely. Five groups with those names had been approved in 2009 and 2010, but zero were approved in 2011. After policy reconsideration in 2012, the backlog was broken and 27 groups were approved, mostly in the second half of the year.

The slowdown was evident with other conservative-sounding groups, as well. Thirty-seven groups with the words patriot or constitution had been approved in 2009 and 2010, but only 10 were approved in 2011. Once again, the backlog was relieved in 2012 with 29 approvals.

On the other hand, groups with the word progressive in their names suffered no similar slowdown pattern. The number of approvals increased each year from 17 in 2009 to 20 in 2012.

http://www.washingtonpost.com/wp-srv/special/politics/irs-targets-conservative-groups/

Huffington Post or Washington Post?

Please Log in or Create an account to join the conversation.